Tax Controversy

Thinking about dealing with an IRS or a DOR matter by yourself? Today, more than ever, tax controversy issues should be handled by a professional. New far-reaching and complex tax regulations, coupled with the IRS’ more aggressive enforcement policies, make it vital to properly plan for and manage IRS examinations in a proactive manner. When the IRS, DOR, or any taxing authority questions your returns through a tax notice or a formal inquiry, you need to be confident that the professional representing you has the experience and skill necessary to quickly deal with the matters that arise.

Sacco & Associates, LLC applies new resolution techniques and procedures to stay ahead of your issues, resolving tax controversy disputes at the lowest level possible to reduce your overall costs. Whether it’s IRS or DOR problems, your tax controversy will be handled thoroughly by tax consultants with years of experience in these areas. We offer a full range of tax controversy services related to IRS and DOR issues, including:

- Pre-examination audit readiness analysis

- Examination planning and representation

- Appeals representation

- Litigation support

- IRS Service Center matters

- IRS penalty and interest abatements

- Compliance matters involving information reporting and withholding

- Non-Filers and voluntary compliance initiatives

- Innocent Spouse Relief

- Responsible Party Assessments & Trust Fund Recovery Penalties

We offer collection action relief in the areas of liens, levies, seizures, installment agreements, and Offer-In-Compromises. With our in-depth knowledge of IRS and DOR practice and procedures, we can assist clients to efficiently resolve difficult matters.

CONTACT US

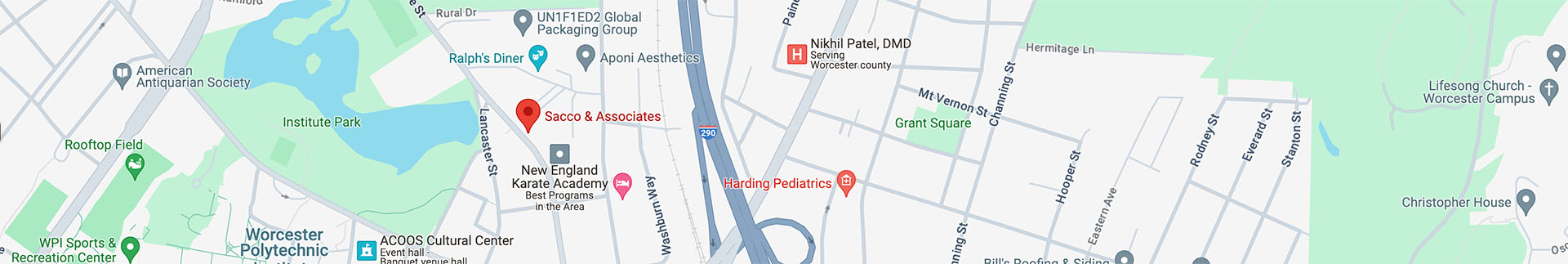

100 Grove Street, Suite 218

Worcester, MA 01605

508-753-6222

508-753-8989